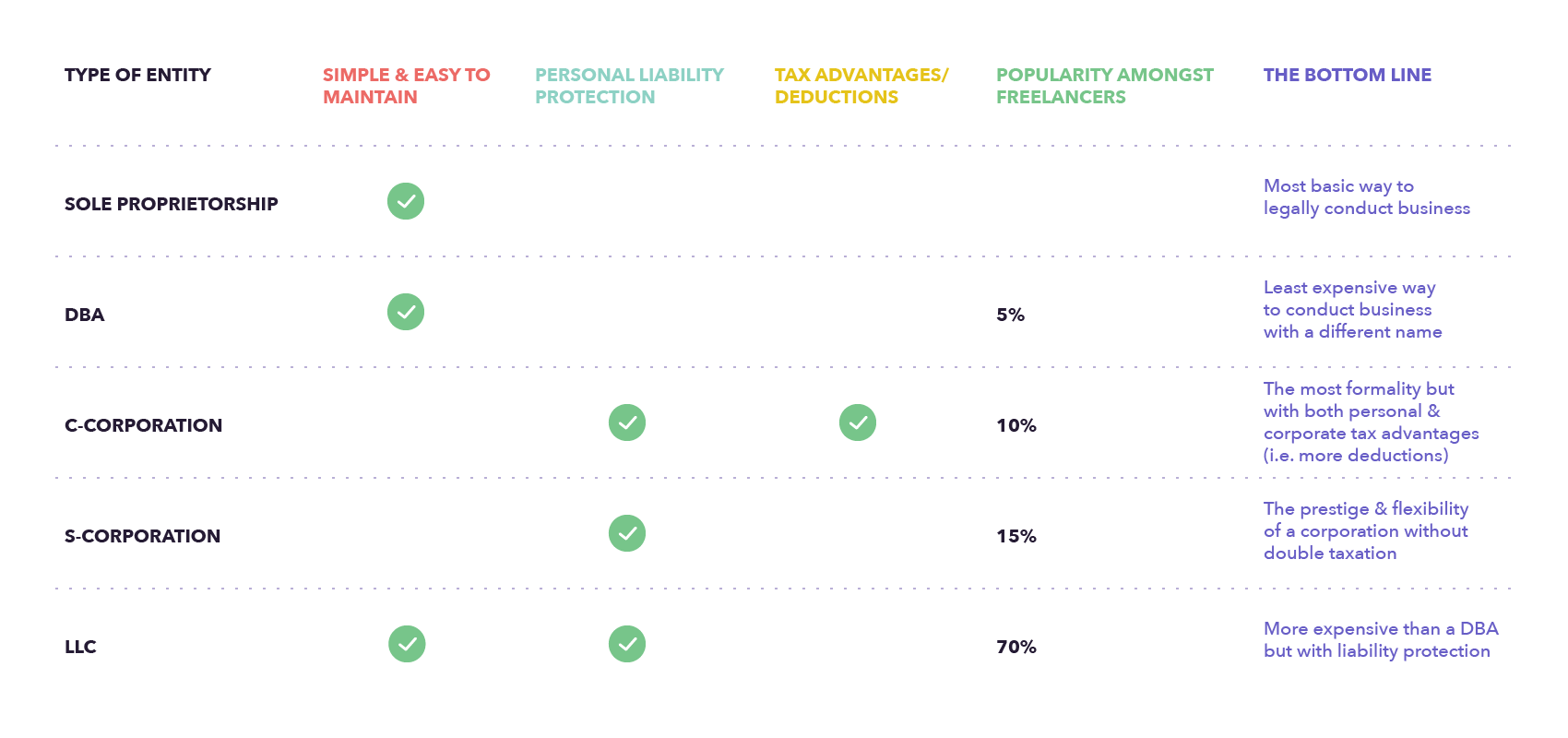

So, you've decided to start your own business. Good for you! Now it's time to get into the nitty gritty and establish a business entity. Choosing a business entity determines the type of income tax return you'll file each year, so it's important to take the decision seriously. But there's no need to worry - we've broken down each choice for you below.

Sole Proprietorship

If you’re self-employed or conducting any sort of business (even if it is run out of your parent’s basement) and haven’t picked a formal structure yet, congratulations you’re officially a sole proprietor by default! There’s no separation between you and the company, so any income earned by the business is considered income earned by the owner and vice versa.

Ex: Lindsey is operating a princess party business as a sole proprietorship, so it’s not related to any title or name other than hers.

Fond of your ride, digs, or coin? Better hold onto those purse strings as creditors can come after your personal property or savings should you run into financial trouble! (Likewise for any lawsuits brought against the business). Make sure to keep track of all income/expenses and report them on a Schedule C with your personal tax return. Mint: Money Manager, Budget & Personal Finance is one awesome app that can make this process easier!

DBA

Affectionately nicknamed “fictitious,” a DBA (standing for Doing Business As) isn’t really a legal structure at all (you sneeeaky tax folks)! It is, however, the least expensive way for small businesses to legally run under a different name without creating a formal entity.

Ex: In order to transact business as “The Princess Party,” Lindsey must file a DBA for that name.

Moral of the story: DBA’s essentially exist just so there’s public record of which individual is behind a business (time for you to wear the crown and own your hard work)!

C-Corporation

It may not be up to Captain America’s standards, but C-Corps make you feel like a superhero by giving you your very own “corporate shield!” Incorporating is the ONLY way to protect your personal assets, and is a separate legal entity (essentially like a separate person) where income and expenses aren’t taxed to the owners but to the corporation (which would also take on any debts and liabilities should they rear their ugly head). A C-Corp has a very formal structure consisting of officers, shareholders, directors and employees (oh you fancy, huh?!) who manage day-to-day activities, select members to serve on the board of directors, and always put important company issues to a vote. So unless your company’s planning on going public, seeking funding/venture capital, looking to invest profits back into the company (or take over the world), this may be administrative overkill. Additionally, if the phrase “no taxation without representation” conjures up nostalgia for high school history class, here you can replace it with “double taxation!” (Your profits will first be taxed at the corporate level and then again at the personal level as dividends - oh joy!)

S-Corporation

If this whole double taxation thing isn’t exactly floatin your boat, it’s time to drop your anchor in your own harbor. After incorporating you can elect S-Corp status enabling the profits, losses and other tax items to pass through the corporation and be reported strictly to you on your personal income tax return. In other good news, you’ll only be taxed on your respective shares of the company’s profits which aren’t subject to self-employment tax!

LLC

If a sole proprietorship and a corporation had an adorable little tax baby, this would be it! (Let’s call him Soul Corp). The most popular choice for small businesses, this structure lessons the owner’s personal responsibility (hence the LL - “limited liability”). But wouldn’t you miss the exhaustive meeting minutes, addendum filings, paperwork and heavy formality that come along with Corporations? Just me and my OCD? Well if flexibility appeals to you, this is your best bet as you also get to choose how you want to be taxed (business income/expenses are reported on your personal tax return). And no you didn’t get asked last to prom, but as the owner of an LLC you’re viewed as a “disregarded” entity (which means you report income and expenses on Schedule C of Form 1040).

If you're interested in learning more, check out Tax Time: 14 Common Freelancer Pitfalls to Avoid.